Financial News

Stay up to date with what is driving financial marketsIntex Tomorrow 22/05/2020

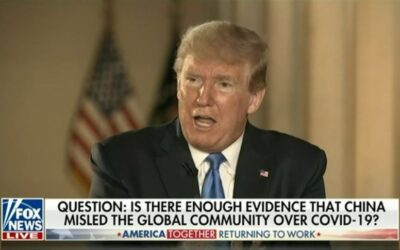

SIGNS OF WEAKNESS Trump started the selloff overnight with some tweets criticising China & the response from China's Global times saying that China will 'defend its interests,' got US traders nervous enough for equities to test earlier lows. There was some clear...

read moreYEN WEAKENS WHILE EQUITIES TREAD WATER

Yen played catchup with yesterday's risk on equity move, weakening across the board. An announcement from the Bank of Japan saying that they would be looking at further easing on Friday helped currencies v's Yen. Japanese yen German ZEW survey came in at -93.5 v's -86...

read moreFrom A Team Member

...

read moreClosed Our AUDJPY Trade

Total Pips Banked Today =...

read moreClosed Our USDCAD Trade

Total Pips Banked Today :...

read moreIntex Insights

MARKETS STEP BACK FROM THE BRINK Trump said that he likes a strong dollar, in contrast to the rest of his presidency where he has been calling for a weak dollar. While a strong USD doesn't help equities, he may have worked out that is helps his popularity Markets...

read moreLONDON OPEN

• LAST DAY SWITCH-AROUND IN RISK • TRUMP RAMPS UP CRITICISM ON CHINA It would have been a kick in the teeth to the 30 million American's who filed for unemployment since March for the month to end near the highs in equities. There is always one ideal time to buy and...

read moreMARKET WRAP

• UST AND USD MOVES SUGGEST RISK OFF CURRENTLY• OIL CLOSES HIGHER AFTER DIPPING TO $10• THE SINGLE CURRENCY WEAKENS AHEAD OF THE ECB The Japanese Yen and Australian dollar battled it out for the strongest currency in the US session with the Aussie coming out on top. ...

read moreMARKET WRAP

• SIGNS OF THE PEAK TO COVID-19 EMERGING• RISK ON SENTIMENT GRINDS THE EQUITIES HIGHER• US DOLLAR RANGE BOUND FOR A MONTH – OIL BACK AT LOWS COVID-19 continues to ravage the world, but signs of a slowdown in infections are starting to emerge as the city of New York...

read moreMARKET WRAP

• US JOB DATA SHOWS JOB DECLINES OVER 10 YEARS• WORLDS PMI’S ARE DOWN• EURUSD SUFFERS AS THE EU LEADERS FAIL TO AGREE US Jobless Claims hit 26million in 5 weeks as the data out today showed worse than expected numbers, with the 4-week average ~5.7million and with...

read moreMARKET WRAP

• OIL NEWS CONTINUES TO DOMINATE• US FISCAL FLOWS COULD SUPPORT EQUITIES It has been a busy day in all things Oil related and the CAD has benefitted from a more positive outlook for the price of Oil going forward, whether that be due to a decrease in production,...

read moreMARKET WRAP

• US DATA COMES IN WORSE THAN EXPECTATIONS• OIL BACK ABOVE ZERO, BUT FOR HOW LONG?• EURGBP BENEFITS FROM A WEAKER UK ECONOMY US Existing Homes Sales for March 2020 came in worse than expected reducing by -8.5% from the previous month. The drop is the largest since...

read moreMARKET WRAP

• CHINAS GDP DATA REFLECTS 2 MONTHS OF LOCKDOWN• RISK OFF SENTIMENT SENDS TRADERS TO SAFE HAVENS• CANADIAN DOLLAR ROCKED BY 18.5 YEAR LOWS IN OIL The big news today was that China’s GDP contracted -6.8% year on year, which is a far cry from the 15% seen in 2007 and...

read moreMARKET WRAP

• US ISM MANUFACTURING DATA ABOVE EXPECTATIONS• OIL DEMAND IS STILL WEAK – SUPPLY IS AT EXTREME HIGHS• CORONAVIRUS TOTAL CASES DISTORTED BY CHINA’S DATA US Factory activity declines but not by as much as the market expected? US ISM Manufacturing PMI for March came in...

read moreLONDON OPEN

• BOE SIGNAL RATE CUTS • US-SINO PHASE 1 • RISK-ON SENTIMENT AT MARKET OPEN At the start of this week traders will be watching the news around the UK economy to see if it will add fuel to the dovish tone set by the Bank of England Governor and two of his MPC...

read more