Though markets moved higher today, it wasn't as bullish a day as earlier in the week.

Copper is currently down on the day, the Australian Dollar had an up day but around half the range of recent days & oil was choppy amongst various OPEC headlines.

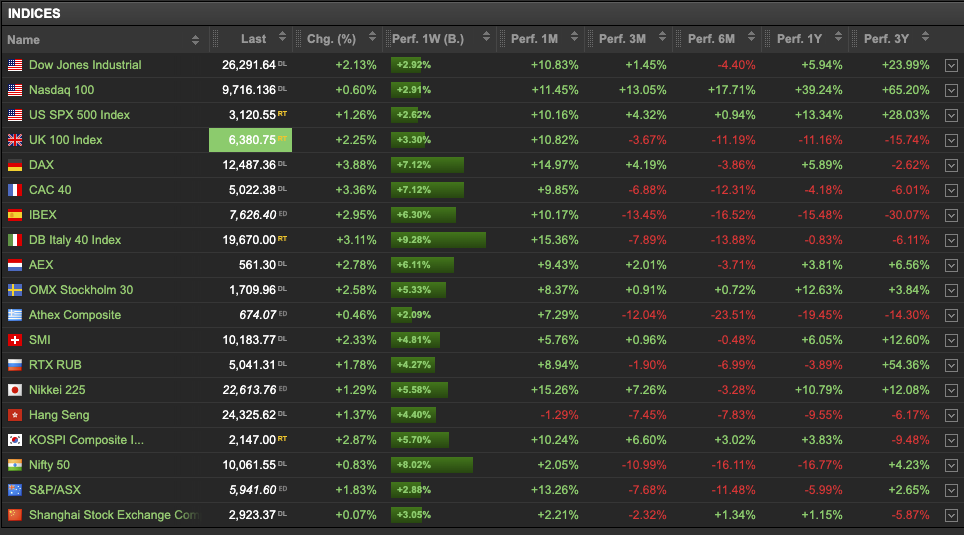

European equities were again the winners, with funds finding their way there (and in to the Euro), as the riots in the US continue to hit the headlines.

This is just a knee-jerk reaction and there is danger that a mis-step from the ECB tomorrow could hurt both the equity rally & the Euro's bull run- or just push funds back to the US.

The riots seem to be quieting down and this may allow COVID headlines to creep in again. Florida cases are on the rise, 2.3% new cases compared to average of 1.4% the last few days & German new cases are ticking up again too.

EURAUD HAS DONE THE ROUND TRIP

EURAUD made a bit of a bounce today after ticking below the February blast off area. It hasn't tested in to 2019 price action at all this year. If AUD can make a final push (or ECB does a decent job of keeping the Euro suppressed), this may tick EURAUD under the 1.6 area to take out some stops & would set up a decent long to play a bounce in time for a potential risk off move in to the weekend.

EYES ON LAGARDE

0230 : AUD Import & Export Data

1245 : EUR ECB Interest Rate Decision

1330 : EUR ECB Presser

1330 : USD Jobless Claims

1900 : CAD BoC's Gravelle speech