The equity market continued its grind higher and volatility dripped down again.

Fed's Bostic was positive on jobs coming back & Powell reiterated that more support from Congress was needed. He also made the point that any curb in main street benefits would curb spending in the economy. Headlines surrounding any delays in the next round of US stimulus may dent risk appetite.

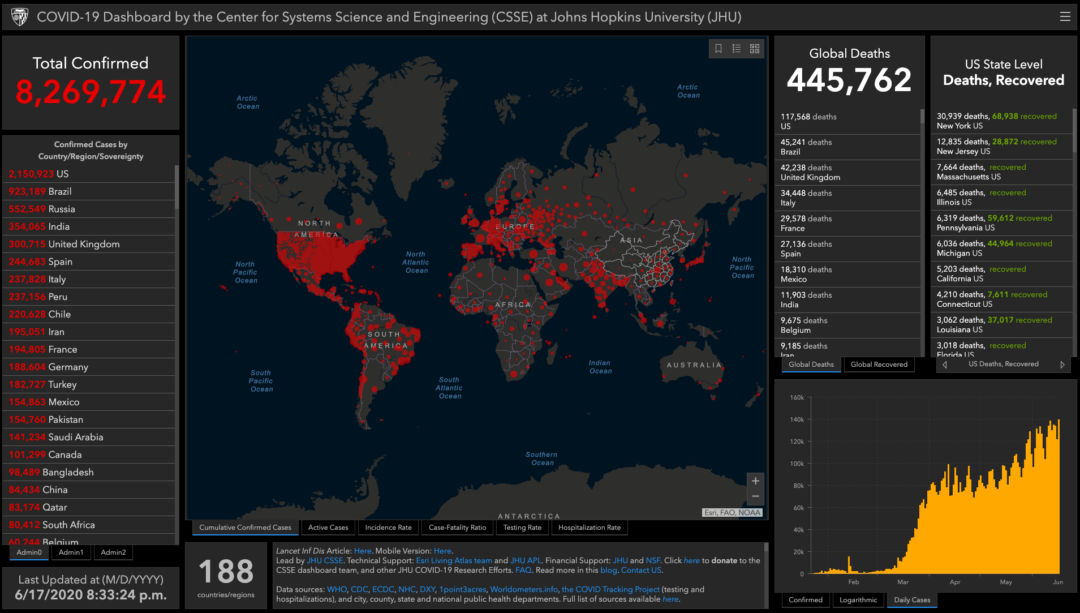

COVID cases continued to spike in the US. We all know it is going to get worse; if the market wanted to respond to this, it would already be lower.

If there begins to be hints of major shutdowns, this could change. For now, there is no expectation of full lockdowns and therefore only positive economic data is due in the coming months. Confirming this idea, Germany's finance minister Scholz said that there wouldn't be a full scale lockdown if there was a secondary outbreak in Germany.

DOES BOE SINK THE POUND?

0230 : AUD Australian Employment Data

0830 : CHF SNB Rate Decision & Policy Assessment

0900 : EUR ECB's New Economic Bulletin

0900 : CHF SNB Pres Conference

1200 : GBP BOE Rate Decision & Minutes

1330 : USD Jobless Claims & Philly Fed Manufacturing Index

1830 : CAD BoC's Schembri speech

CABLE COULD LEAD THE WAY

The 2019 open, around 1.276, has become a pivotal area. Cable looks to be backing off and into the recent range between 1.215 and 1.265. However on Monday, amid a boost in risk on, it held around 1.26 and has yet to make a decisive break lower.

The argument for USD bears is that due to the massive amount of stimulus the Fed & US government has loaded into the system (and still promise to do more), the USD will weaken. With BOE expected to add more stimulus tomorrow, if Cable holds up it will be a sign that USD has lower to go.