Intex Open Trades

| CCY Pair | Long/Short | Stop @ | Entry |

| EURGBP | Long | 0.88704 | |

| XAGUSD | Long | 16.642 | |

| EURUSD | Short | 1.1165 | 1.0905 |

| AUDJPY | Short | 71.97 | 70.47 |

| EURJPY | Short | 120.86 | 119.66 |

| USDCAD | Long | 1.3702 | 1.3882 |

| GBPJPY | Short | 133.82 | 132.66 |

| CCY Pair | Long/Short | Stop @ | Entry |

| EURGBP | Long | 0.88704 | |

| XAGUSD | Long | 16.642 | |

| EURUSD | Short | 1.1165 | 1.0905 |

| AUDJPY | Short | 71.97 | 70.47 |

| EURJPY | Short | 120.86 | 119.66 |

| USDCAD | Long | 1.3702 | 1.3882 |

| GBPJPY | Short | 133.82 | 132.66 |

Amid general USD weakness with the current risk-on tone, the Euro eventually broke out of its multi-month range. As long as it holds above 1.1 tomorrow, the month-end close will be strong and should open up room for another squeeze higher. 1.115 is the next key area.

While AUD & NZD were up v's USD, they notably lagged v's the Euro & Sterling. CAD was slightly down v's USD. If this pattern continues, it shows a slight risk-off tilt.

Copper, though down early in the day, rallied and is currently at the highs, with bond yields also holding up and oil at the highs as well. Risk happens slowly and then all at once, of course, but so far this market is only seeing the positives ahead.

0050 : JPY Business Climate (May)

0700: EUR Retail Sales

0900 : EUR GDP

1000 : EUR CPI

1330: USD Personal Expenditure

1330 : CAD GDP

1445 : USD Chicago PMI

1500 : USD Michigan Consumer Sentiment

1600 : USD Fed Powell Speaks

There was a bit of technical weakness at key areas today; key areas that everyone is surely watching, which usually means one thing; the first trade is the wrong one.

AUDUSD got about 10 pips above its 2019 low before reversing, EURUSD spiked above 1.1 but couldn't hold the move (helped by the European Commission's proposal roughly along the lines of the original German/French bailout of the EZ). SP500 dipped back below the 3K mark though has since rebounded, however it still holds under the 200 DMA.

The Pound was arguably the weakest currency today, failing not around technical levels but just continuing to drift lower, with a UK spokesperson commenting that there is no change to the government's view that an extension will not be looked for, with the June deadline fast approaching.

1000 : EUR Business Climate (May)

1300 : EUR Consumer Prices

1330 : USD GDP Preliminary

1330 : USD Initial Jobless

1330: USD Durable Goods

1500 : USD Pending Home Sales

1600 : USD Fed's Williams Speech

Yen played catchup with yesterday's risk on equity move, weakening across the board. An announcement from the Bank of Japan saying that they would be looking at further easing on Friday helped currencies v's Yen.

German ZEW survey came in at -93.5 v's -86 expected, though there was a lot of optimism in the report showing an expectation that the rebound will get underway soon now that economies are re-opening.

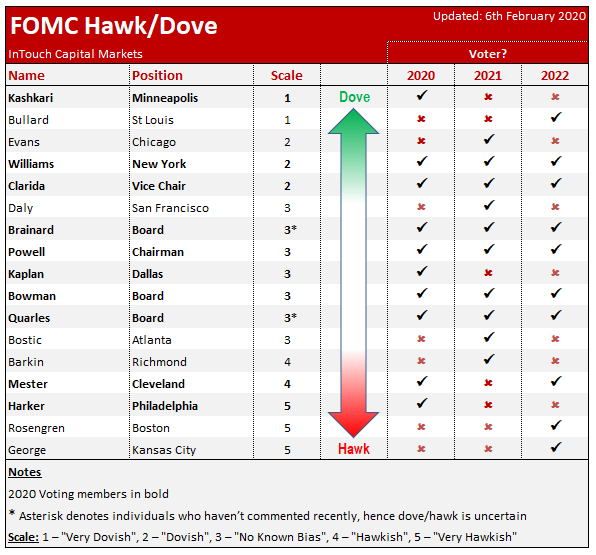

Fed Chair Powell was testifying in Congress today and didn't say anything that surprised the market, continuing the viewpoint that the Fed will do all it can to support the short term market but the more fiscal stimulus is required to support the longer-term recovery of the economy; over to Congress.

FOMC MINUTES LOOM & CAN CAD MAKE A BREAK?

1900 : USD FOMC Minutes

It's a big day tomorrow, with CAD data in the afternoon followed by FOMC minutes. USDCAD has drifted back to the lows of its recent range - will there be a false breakout to the downside before the upward momentum comes back?

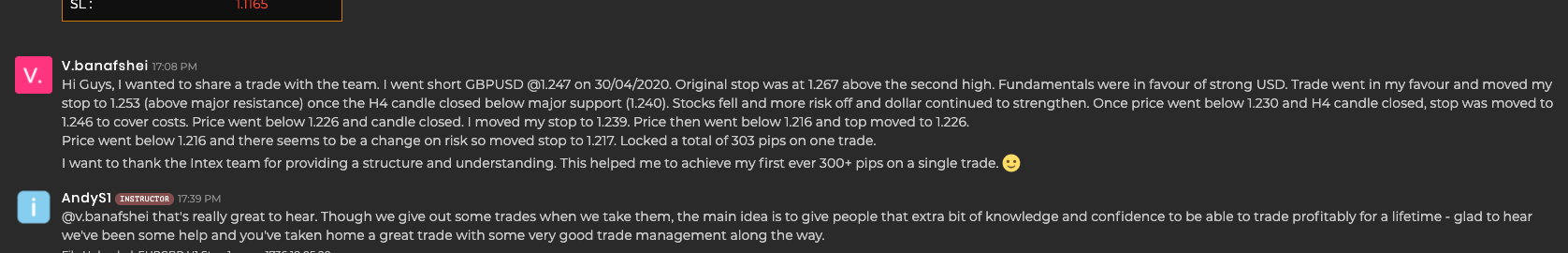

Hi Guys, I wanted to share a trade with the team. I went short GBPUSD @1.247 on 30/04/2020. Original stop was at 1.267 above the second high. Fundamentals were in favour of strong USD.

Trade went in my favour and moved my stop to 1.253 (above major resistance) once the H4 candle closed below major support (1.240). Stocks fell and more risk off and dollar continued to strengthen. Once price went below 1.230 and H4 candle closed, stop was moved to 1.246 to cover costs. Price went below 1.226 and candle closed. I moved my stop to 1.239. Price then went below 1.216 and top moved to 1.226.

Price went below 1.216 and there seems to be a change on risk so moved stop to 1.217. Locked a total of 303 pips on one trade.I want to thank the Intex team for providing a structure and understanding. This helped me to achieve my first ever 300+ pips on a single trade.

Every day we produce content, analysis, trade ideas and fundamental insight into the markets that we trade. Along the way we try and help our community with mentoring and updates. If you would like to trade with us or just see what we do, come into our Trading Room at htttp://www.forexvox.com - click on the Intex Markets room.

Total Pips Banked Today = 140